IBM Launches Enhanced Data Security Feature in Multi-Cloud

International Business Machines Corporation IBM recently launched enhanced data security features across hybrid and multi-cloud environments to thwart the growing menace of cyberattacks and strengthen cyber resiliency. The Key Management Services (KMS) like IBM Key Protect for IBM Cloud or IBM Cloud Hyper Protect Crypto Services offer full encryption visibility and essential control over sensitive data.

This industry-first cloud service will help business enterprises mitigate risks to data safety in multi-cloud setup with zero trust security architectures and securely manage encryption keys with a single point of control, including across other public clouds. The KMS will enable firms to better manage the data encryption keys and protect them by additionally encrypting the data encryption keys with a user-owned root key (envelop encryption). It also handles the lifecycle of the user’s root keys and ensures that these are only accessible to their rightful owner.

This, in turn, will give more flexibility to companies regarding security configurations and allow for the division of responsibilities for where the root key is stored and where it is used. IBM Cloud further offers Unified Key Orchestrator that leverages its encryption capabilities, hybrid cloud expertise and automation to help organizations maintain full visibility and control over who has access to their critical data. The KMS system is deemed to be the prerequisite to safely manage all the root keys needed to securely encrypt/decrypt the sensitive data on the Satellite data repositories and is likely to be a key growth driver for the company in the long run.

IBM expects its growth to be driven primarily by analytics, cloud computing and security services. A better business mix, improving operating leverage through productivity gains and increased investments in growth opportunities will likely drive its profitability.

However, IBM’s ongoing, heavily time-consuming business model transition to the cloud is likely to be a headwind in the near term. Although the public cloud market is expected to be one of the fastest-growing IT categories with about 25% to 30% CAGR over the next five years, IBM is unlikely to keep up with its competitors. High integration risks from continuous acquisition spree are potent challenges. In addition, weakness in its traditional business and foreign exchange volatility remain significant concerns. Also, higher profit on lower revenues indicates that the company has been lowering costs to maintain profits. We believe that the scope for further cost-cutting is limited. Consequently, if costs are further reduced, there could be a negative impact on product quality. It could also lead to an additional delay in launching products, denting its long-term growth potential to some extent.

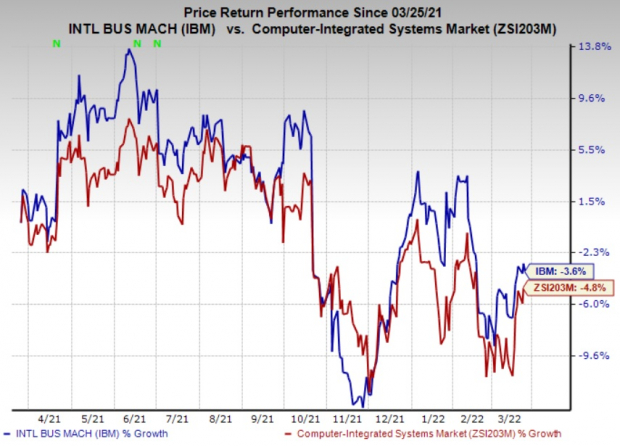

The stock has lost 3.6% over the past year compared with the industry’s decline of 4.8%. We are impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

Hewlett Packard Enterprise Company HPE, carrying a Zacks Rank #2 (Buy), is a better-ranked stock in the industry. It has a long-term earnings growth expectation of 6% and delivered an earnings surprise of 10.7%, on average, in the trailing four quarters. Over the past year, Hewlett Packard has gained a modest 10.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings estimates for the current year for the stock have moved up 8.2% over the past year, while that for the next fiscal are up 14.9%. Hewlett Packard has been pursuing acquisitions to focus more on high-margin hybrid IT models that leverage on-premises and cloud-computing power. It views AI, Industrial IoT and distributed computing as the next major markets.

Viavi Solutions Inc. VIAV, carrying a Zacks Rank #2, is a solid pick for investors. It delivered a modest earnings surprise of 15.6%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 10.8% since March 2021, while that for the next year are up 9.2%.

Viavi boasts a comprehensive product portfolio that offers end-to-end network visibility and analytics that help build, test, certify, maintain and optimize complex physical and virtual networks. Its wireless and fiber test solutions are in the early stages of a multi-year investment cycle fueled by the transition of OEMs and service providers to superfast 5G networks. Viavi expects growth to be driven by the secular demand for 5G wireless, fiber and 3D sensing.

Knowles Corporation KN sports a Zacks Rank #1. It has a long-term earnings growth expectation of 10% and delivered a modest earnings surprise of 14.9%, on average, in the trailing four quarters. Earnings estimates for the current year have moved up 21% since March 2021.

The transformation from an acoustic component supplier to an audio solutions provider has enabled Knowles to migrate to higher-value solutions and increase content per device. This, in turn, has empowered the company to capitalize on the positive macro trends in audio and edge processing solutions.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021 Zacks Top 10 Stocks portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank.

Found this interesting? Then check our main news page where you can find all articles related to Crypto, Crime, Darknet, Security and much more!